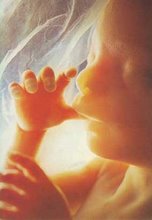

Image via Wikipedia

CHICAGO, July 6 /Christian Newswire/ -- Today, the Internal Revenue Service (IRS) was put on notice that the Thomas More Society in Chicago stands ready to defend the Coalition for Life of Iowa against the prejudicial questioning by the IRS, which has delayed granting tax exemption to the non-profit religious organization. After questioning the "educational" nature of the Coalition's materials, prayer meetings, talks and other Pro-Life activities, the IRS stated that it would not grant tax exemption until the Coalition swore to limit its "picketing" and "protesting" of Planned Parenthood.

In their response, attorneys of the Thomas More Society defending the Coalition, argued that the IRS is in danger of violating the First Amendment and that the request for tax exemption should be promptly granted. The repeated questioning of the Coalition suggests that the IRS may be denying or delaying tax- exempt status to an eligible organization based solely upon its religious affiliation and speech. Many other organizations regularly advocate on both sides of these issues, and they have not been hindered in obtaining or maintaining tax-exempt status under section 501(c)(3).

"The IRS not only erroneously forbade the Coalition for Life of Iowa from engaging in 'advocacy' as a section 501(c)(3) non-profit organization; they also never gave any explanation as to why their request was relevant," said Thomas Brejcha, president and chief counsel for the Thomas More Society. "The Coalition has clearly and truthfully stated that all its activities fall in line with IRS guidelines. The IRS is protecting Parenthood and harassing the Coalition for Life of Iowa."

Thomas More attorneys verify in their response that the Coalition for Life of Iowa has never engaged in any disruptive, violent or threatening action. Its activities, such as prayer meetings and events held to educate the public about sanctity of life issues, have been peaceful. As nearly all of its funds go toward education and the "advancement of religious beliefs," which falls under the definition of "charitable" under section 501(c) (3), the Coalition should thus be clearly eligible for immediate tax-exempt status from the IRS.

"By their own regulations, the IRS must take up a position of with respect to the beliefs advocated by an organization," said Brejcha. "If the IRS can discriminate against one non-profit based on its beliefs and religious affiliation, then the IRS could regulate the speech of any other non-profit organization."

COPIES OF THE LETTER TO THE IRS AND ALL SUPPORTING DOCUMENTS AVAILABLE UPON REQUEST

The Thomas More Society is a public interest law firm that counsels and defends those who work to protect innocent human life, defends those who proclaim faith-based values in our nation's public square, and strives to protect the institution of marriage as a union of man and woman formed to beget, bear and nurture new human lives. For more information, please visit: www.thomasmoresociety.org.